Find Conviction & Stop FOMO when Trading Memecoins

by soru, Senior Moderator of SolanaMemecoins

What is important to know?

The world of memecoins is fast-paced, exciting, and unpredictable. Whether you're trading memecoins or other cryptocurrencies, it's easy to fall into the trap of FOMO (Fear of Missing Out). As prices rise and social media hype escalates, many traders make impulsive decisions—buying at the top or selling too soon—driven by the fear of missing out on potential gains. But there's a way to stay calm in the chaos: building conviction. In this blog, we'll break down how to develop conviction when trading memecoins and avoid the emotional falls of FOMO.

What is FOMO in Trading?

The Hype on a Coin will make most people FOMO in!

FOMO is a psychological trigger where traders feel pressured to act based on the fear of missing out on profits. In the case of memecoins, which are often driven by hype rather than fundamentals, FOMO can cause traders to make stupid decisions. Seeing others profits rise may lead you to buy in at the worst possible moment—right before a crash / dip.

Why Conviction Matters in Trading Memecoins

Now that your wallet’s ready, it’s time to dive into the action. BullX has an Explorer Tab where you can see which coins are trending—sorted by volume and swaps. This is where you start finding those hidden gems.

What is Conviction

In contrast to FOMO, conviction is a trader's confidence in their analysis, strategy and research, not influenced by short-term market noise or social media trends.

The Benefits of Conviction in a Volatile Market

Trading memecoins requires a certain level of risk tolerance, but traders who rely on conviction are less likely to panic sell on dips. Conviction helps you: Stay calm during market volatility Avoid panic-selling during dips Hold onto coins through hype cycles for bigger gains For instance, a trader with conviction might hold their position despite a temporary downturn, trusting in their research.

How to Build Conviction When Trading memecoins

1. Research Memecoins Thoroughly

Before you buy into a coin, it's essential to do your homework. Analyze the team behind the project, their roadmap, and the market potential. For memecoins, consider factors like: Developer / Team engagement Market trends / derivatives for memecoins on Solana The more you know about a coin, the more confident you'll be in your trading decisions.

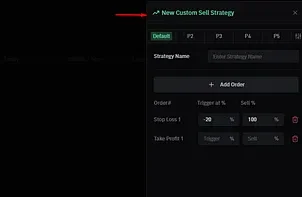

2. Set a Clear Plan

A well-defined trading plan is a key tool for avoiding FOMO. Determine: Your entry and exit points Your target profits How much you're willing to risk Sticking to your plan helps eliminate emotional decision-making, even when prices spike or drop rapidly.

3. Practice Risk Management

Diversify your investments to manage risk effectively. While memecoins trading can offer high rewards, they are also highly volatile. Avoid putting all your capital into one coin, and instead, spread it across different assets to minimize potential losses.

How to Stop FOMO when Trading Volatile Memecoins

1. Avoid the Hype

Social media platforms like Twitter and Reddit can amplify FOMO. It's important to recognize that the loudest voices on these platforms are often not the most informed. To prevent FOMO, limit your exposure to these channels, especially during volatile times.

2. Focus on Long-Term Goals

Rather than reacting to short-term price movements, focus on your long-term investment goals. Are you looking for quick profits, or are you in it for the long haul? Defining your objectives can help you resist the urge to buy or sell based on temporary market swings.

3. Learn from Your Mistakes

If you've fallen prey to FOMO before, use those experiences as learning opportunities. Reflect on what triggered your fear and how you can avoid it next time. Every trade, whether successful or not, offers valuable insights

Conclusion

In this blog post, you learned how to build conviction and avoid FOMO when trading memecoins, particularly Solana memecoins. By conducting thorough research, creating a clear trading plan, and staying focused on long-term goals, you can overcome the emotional pitfalls of FOMO and make more informed trading decisions